Money Management is the 'KING'

No strategy will work if your mindset, risk and money management are poor.

Money management allows you to protect your Trading/Investing capital and also helps you to optimize your trading system performance. If you don’t follow strict money management, it’s not possible to win the financial markets. Having the proper position sizes, understanding where to place and move your stop losses, and taking into account the risk-to-reward ratio are all examples of effective risk management. Money management helps you to trade without stress.

In this financial market Making money shouldn’t be your primary objective; instead, you should aim to avoid losing money.

Money Management is the 'KING'

No strategy will work if your mindset, risk and money management are poor.

Money management allows you to protect your Trading/Investing capital and also helps you to optimize your trading system performance. If you don’t follow strict money management, it’s not possible to win the financial markets. Having the proper position sizes, understanding where to place and move your stop losses, and taking into account the risk-to-reward ratio are all examples of effective risk management. Money management helps you to trade without stress.

In this financial market Making money shouldn’t be your primary objective; instead, you should aim to avoid losing money.

The following Risk management points should be known before entering into a trade or manage a trade

1. Trading Capital 2. How much to take risk 3. Position sizing 4. When to Increase Capital

The following Risk management points should be known before entering into a trade or manage a trade

1. Trading Capital 2. How much to take risk 3. Position sizing 4. When to Increase Capital

1. Trading Capital

Trading capital is a term used to describe the money that a trader has available to buy and sell different assets on these financial markets.

Never deposit more money into a trading account than you are not willing to lose as a trader.

We advise novice traders when they are in the learning phase of trading only put money into their trading capital to learn and they are willing to lose that capital.

There is no thumb rule to add this or that much capital because it varies from person to person but keep it as minimum as possible in the beginning and once you got confidence in your system then plan as per your yearly/monthly goal target.

1. Trading Capital

Trading capital is a term used to describe the money that a trader has available to buy and sell different assets on these financial markets.

Never deposit more money into a trading account than you are not willing to lose as a trader.

We advise novice traders when they are in the learning phase of trading only put money into their trading capital to learn and they are willing to lose that capital.

There is no thumb rule to add this or that much capital because it varies from person to person but keep it as minimum as possible in the beginning and once you got confidence in your system then plan as per your yearly/monthly goal target.

2. How much to take Risk?

Beginners should follow the 1% rule that is required for novices in this financial market.

But the rule advises for large investors and traders whose trading/investment capital is in crores not to take risks of more than 2% of trading capital in all positions.

But if you ask any real trader, he will always advise you that once you feel confident in your system and if your trading capital is below 10 lakhs, you will have to risk 2% to 5% of your trading capital.

Assume, you are willing to lose 3% of your trading capital and your initial trading capital is Rs. 1,00,000.

Now your –

Trading Capital – Rs. 1,00,000

Risk on capital – 3%

Total risk = Rs. 3,000

2. How much to take Risk?

Beginners should follow the 1% rule that is required for novices in this financial market.

But the rule advises for large investors and traders whose trading/investment capital is in crores not to take risks of more than 2% of trading capital in all positions.

But if you ask any real trader, he will always advise you that once you feel confident in your system and if your trading capital is below 10 lakhs, you will have to risk 2% to 5% of your trading capital.

Assume, you are willing to lose 3% of your trading capital and your initial trading capital is Rs. 1,00,000.

Now your –

Trading Capital – Rs. 1,00,000

Risk on capital – 3%

Total risk = Rs. 3,000

Why protecting money is much more important than return?

The question is why everyone is advised not to risk more than 2-5% of their trading capital, to know that you must know the recovery formula.

If you lose 3% of your trading capital then you need a 3.1% return to get back to break even,

And if you lose 5% of your trading capital then you need a 5.26% return to get back to break even.

Let’s calculate,

Suppose your initial trading capital = 1,00,000

lose = 5%

Now your trading capital = 5% of 1,00,000 = 95,000

So to get back to break even after a loss of 5%, how much the return is required?

Now, after a loss of 5% of your initial trading capital = 95,000

Return required =5.26%

For break even = 5.26% of 95,000 = 4,997

Total = 95,000 + 4,997 = 99,997 (Near 1,00,000).

Now you can clearly understand why, in the financial market, protecting money is much more important than getting money.

Why protecting money is much more important than return?

The question is why everyone is advised not to risk more than 2-5% of their trading capital, to know that you must know the recovery formula.

If you lose 3% of your trading capital then you need a 3.1% return to get back to break even,

And if you lose 5% of your trading capital then you need a 5.26% return to get back to break even.

Let’s calculate,

Suppose your initial trading capital = 1,00,000

lose = 5%

Now your trading capital = 5% of 1,00,000 = 95,000

So to get back to break even after a loss of 5%, how much the return is required?

Now, after a loss of 5% of your initial trading capital = 95,000

Return required =5.26%

For break even = 5.26% of 95,000 = 4,997

Total = 95,000 + 4,997 = 99,997 (Near 1,00,000).

Now you can clearly understand why, in the financial market, protecting money is much more important than getting money.

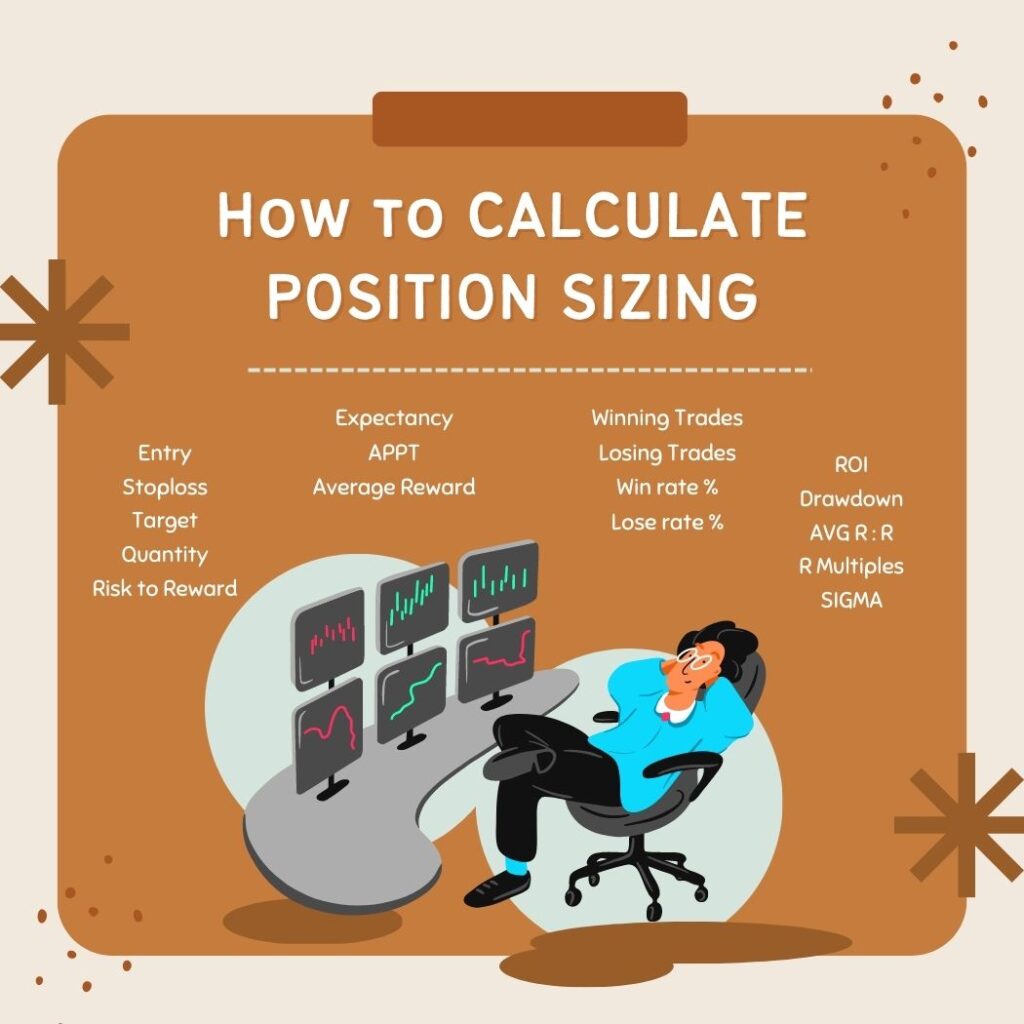

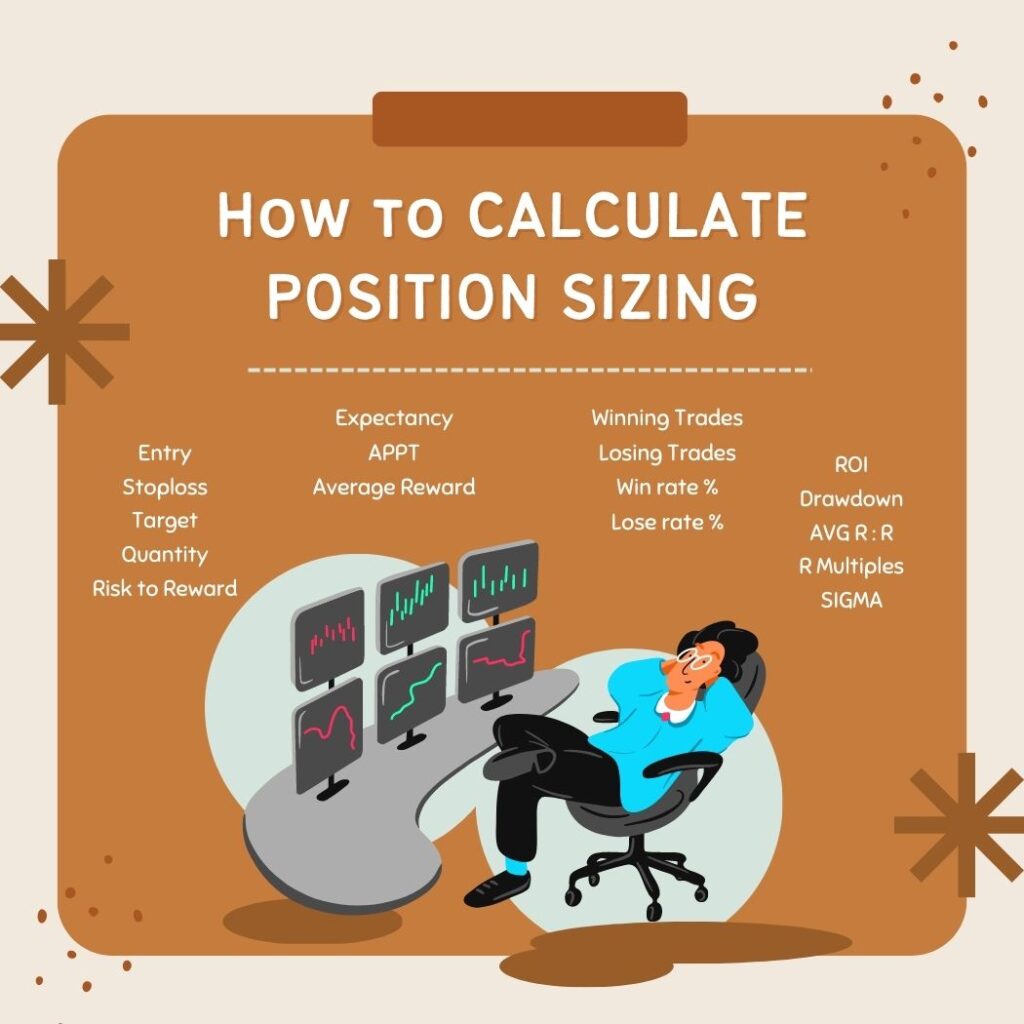

3. Position Sizing - Quantity to buy

The correct position size of a stock is the number of shares of a stock or security you invest in, which is more important than the price levels where you enter or exit a trade. If your position size is either small or too large, you can wind up taking excessive risks or not enough risks for you to make money from a trade. We had already discussed about the account risk limit. Now we are going to calculate your per-trade position sizing.

To calculate your position sizing or quantity to buy, you have to know your Entry and Exit price levels.

You can’t imagine if we’ll say your per-trade position sizing (Quantity to buy) depends on your Yearly target. Let’s understand by using a simple math.

Let’s say,

your yearly goal is to make= Rs. 1,08,000

Monthly goal = yearly goal/Number of months in a year

Monthly goal = Rs. 1,08,000/12

Monthly goal = Rs. 9,000

It means you need a reward of Rs 9000/- in a month to achieve your yearly target.

And our RSI Ferrari strategy gives you 3 times (3R) the target of your initial risk – (R:R is 1:3)

So your initial risk (1R) of your trade is = Rs. 9,000 / 3 = Rs. 3,000

Initial Risk (1R) = Rs. 3,000

Your Risk to Reward will be = 1:3 = 3000:9000

However, your initial risk (1R), which is Rs. 3,000, is only computed if you want to make one trade for the entire month.

But in order to diversify our risk and win the probability game, let’s say we are going to make number of trades in a month = 10

Now,

per trade risk = Initial risk/number of trades planned

Per Trade Risk = 3,000 / 10 =

Per Trade Risk = 300

To calculate your position sizing (number of shares to buy) you have to know your Entry and Stoploss point.

Let’s say, in a stock (XYZ) –

Entry Price is = 785

Stoploss Price is = 760

Per share risk = (Entry price – Stoploss price)

Per share risk = (785-760)

Per share risk = 25

Your position sizing / Quantity to buy = (Per Trade Risk / Per share risk)

Your position sizing / Quantity to buy = (300/25)

Your position sizing / Quantity to buy = 12

Now calculate, if your stop loss hits

Then your loss will be = Quantity to buy * Per share risk

Total loss will be = 12 * 25

Total loss will be = 300

Assume, if your all stop loss hits then your total loss will be = 300 * 10 = 3,000

It means your monthly risk (1R) which is 3,000 is under your control.

However, there are occasions when the index does not perform during the entire month, and at those periods or when an uptrend is beginning, you must double your risk which is Rs. 6,000.

3. Position Sizing - Quantity to buy

The correct position size of a stock is the number of shares of a stock or security you invest in, which is more important than the price levels where you enter or exit a trade. If your position size is either small or too large, you can wind up taking excessive risks or not enough risks for you to make money from a trade. We had already discussed about the account risk limit. Now we are going to calculate your per-trade position sizing.

To calculate your position sizing or quantity to buy, you have to know your Entry and Exit price levels.

You can’t imagine if we’ll say your per-trade position sizing (Quantity to buy) depends on your Yearly target. Let’s understand by using a simple math.

Let’s say,

your yearly goal is to make= Rs. 1,08,000

Monthly goal = yearly goal/Number of months in a year

Monthly goal = Rs. 1,08,000/12

Monthly goal = Rs. 9,000

It means you need a reward of Rs 9000/- in a month to achieve your yearly target.

And our RSI Ferrari strategy gives you 3 times (3R) the target of your initial risk – (R:R is 1:3)

So your initial risk (1R) of your trade is = Rs. 9,000 / 3 = Rs. 3,000

Initial Risk (1R) = Rs. 3,000

Your Risk to Reward will be = 1:3 = 3000:9000

However, your initial risk (1R), which is Rs. 3,000, is only computed if you want to make one trade for the entire month.

But in order to diversify our risk and win the probability game, let’s say we are going to make number of trades in a month = 10

Now,

per trade risk = Initial risk/number of trades planned

Per Trade Risk = 3,000 / 10 =

Per Trade Risk = 300

To calculate your position sizing (number of shares to buy) you have to know your Entry and Stoploss point.

Let’s say, in a stock (XYZ) –

Entry Price is = 785

Stoploss Price is = 760

Per share risk = (Entry price – Stoploss price)

Per share risk = (785-760)

Per share risk = 25

Your position sizing / Quantity to buy = (Per Trade Risk / Per share risk)

Your position sizing / Quantity to buy = (300/25)

Your position sizing / Quantity to buy = 12

Now calculate, if your stop loss hits

Then your loss will be = Quantity to buy * Per share risk

Total loss will be = 12 * 25

Total loss will be = 300

Assume, if your all stop loss hits then your total loss will be = 300 * 10 = 3,000

It means your monthly risk (1R) which is 3,000 is under your control.

However, there are occasions when the index does not perform during the entire month, and at those periods or when an uptrend is beginning, you must double your risk which is Rs. 6,000.

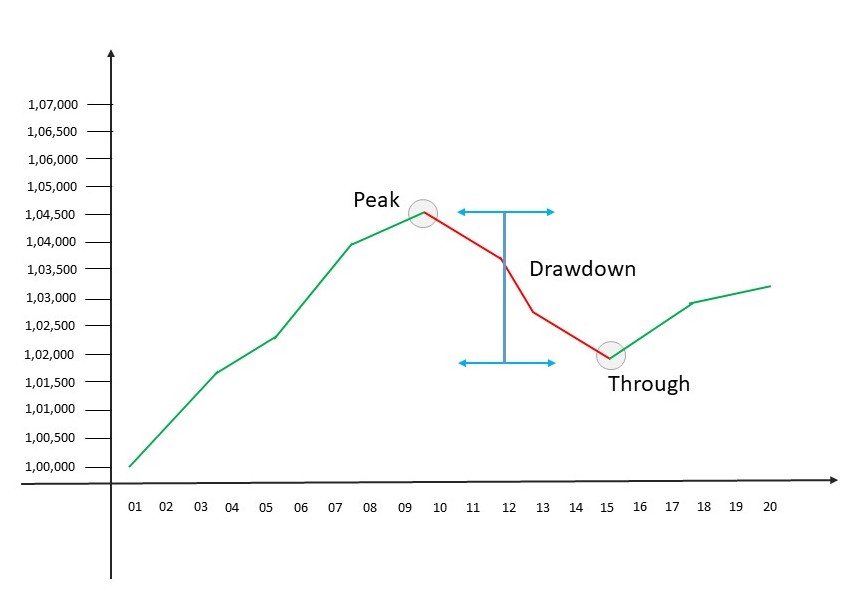

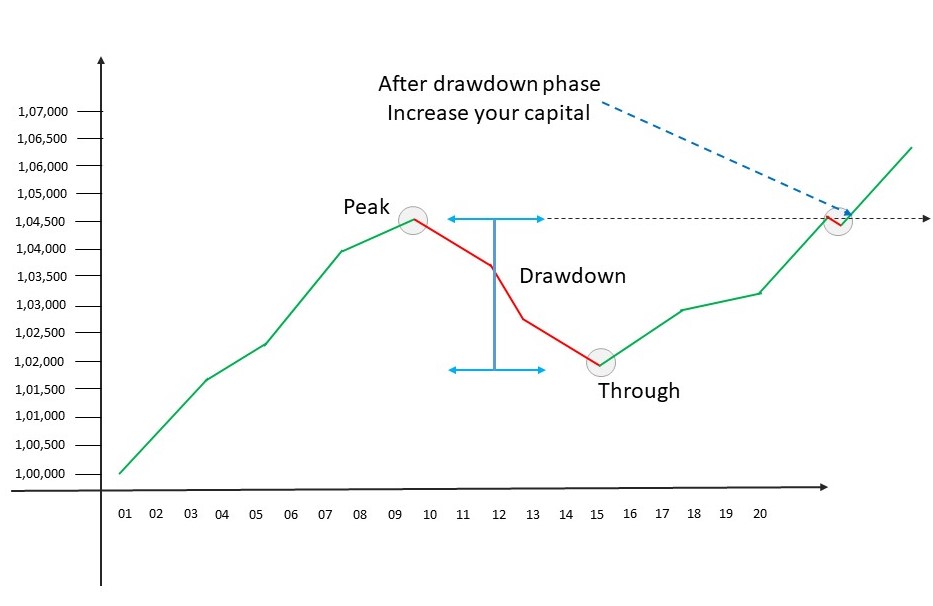

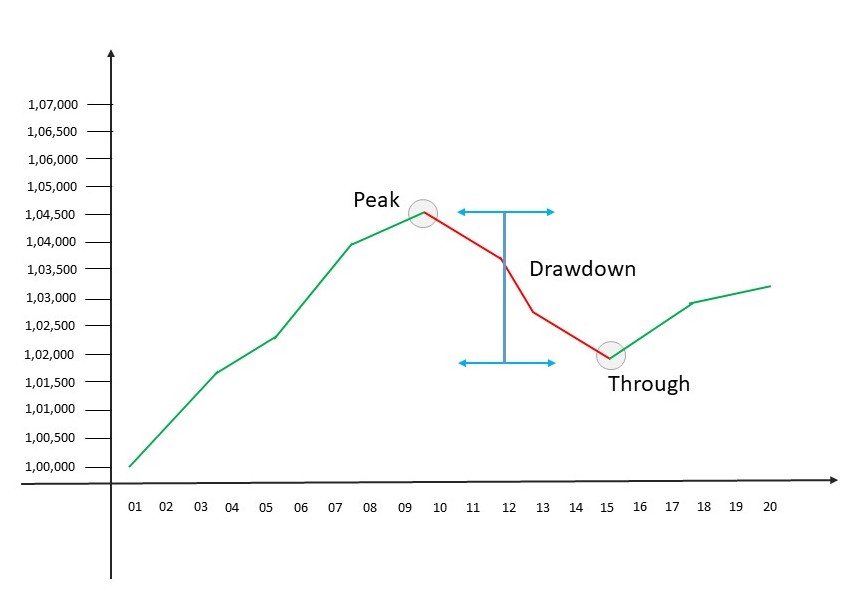

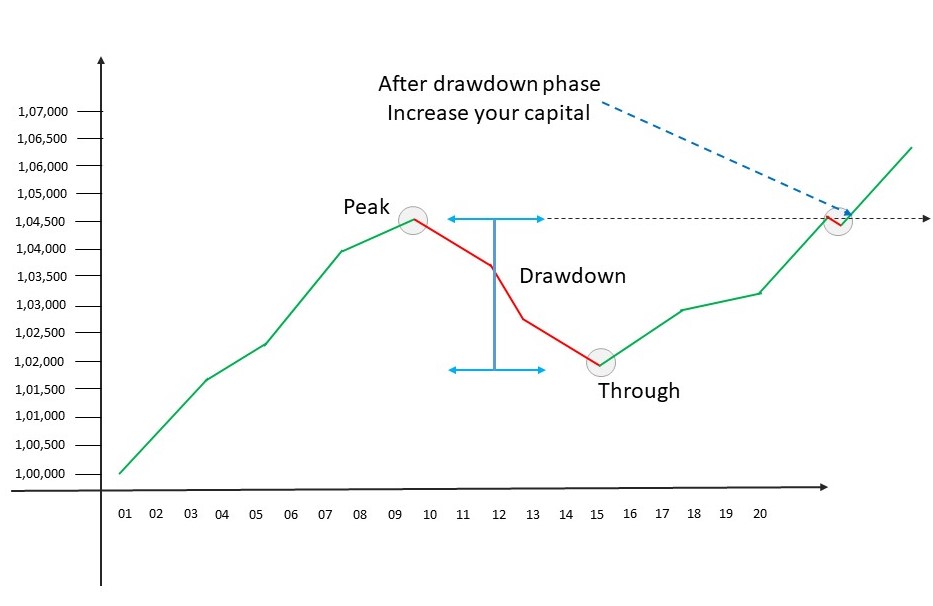

4. When to increase trading capital

The only answer to increasing your trading capital is after ‘Drawdown’ (expected shortfall) and when you are 100% confident in your trading strategy and risk management. Before making any decision to increase trading capital make sure that the trading strategy is still in line with your financial goals and risk tolerance.

Let’s again do a simple math –

Let’s assume, your trading capital = 1,00,000

System Risk to Reward = 1:3

System win rate = 60%

Risk on each trade = 300

Reward on each trade = 900

you planned to trade on a month = 10

If your system win rate is 60% and you take 10 trades in a month –

Total winning trades = 6

Total losing trades = 4

After 10 trades –

Total profit = winning trades x reward on each trade

Total profit = 6 x 900 = 5400

Total loss = losing trades x loss on each trade

Total loss = 4 x 300 = 1200

Net P/L = Total profit – Total loss

Net P/L = 5400 – 1200 = 4200

Net P/L = 4200

After profit, your trading capital = initial capital + profit

Trading capital = 1,00,000 + 4200 = 1,04,200

Account increased in % = 4.2%

What happened, if you increase your capital before drawdown phase?

Now, you have decided to increase and doubled your capital = 1,00,000 + 1,00,000 = 2,00,000

And you have doubled your Risk to Reward, So your –

Risk on each trade = 600

Reward on each trade = 1800

But this month your systems drawdown phase starts

Total trades planned for this month = 10

But because of the drawdown

Total profit = 0 x 1800 = 0

Total loss = 10 x 600 = 6000

After two months of trading, your net capital = (2,04,200 – this month’s loss)

Total capital = 2,04,200 – 6000

Total capital = 1,98,200

Total loss = 2,00,000 – 1,98,200 = 1,800

Total loss = 1,800

Now you can clearly understand what if you increased your capital before the drawdown phase.

Conclusion

The only way to increase your trading capital is after ‘Drawdown’ and when you are 100% confident in your trading strategy and most important when you believe in yourself and your system.

4. When to increase trading capital

The only answer to increasing your trading capital is after ‘Drawdown’ (expected shortfall) and when you are 100% confident in your trading strategy and risk management. Before making any decision to increase trading capital make sure that the trading strategy is still in line with your financial goals and risk tolerance.

Let’s again do a simple math –

Let’s assume, your trading capital = 1,00,000

System Risk to Reward = 1:3

System win rate = 60%

Risk on each trade = 300

Reward on each trade = 900

you planned to trade on a month = 10

If your system win rate is 60% and you take 10 trades in a month –

Total winning trades = 6

Total losing trades = 4

After 10 trades –

Total profit = winning trades x reward on each trade

Total profit = 6 x 900 = 5400

Total loss = losing trades x loss on each trade

Total loss = 4 x 300 = 1200

Net P/L = Total profit – Total loss

Net P/L = 5400 – 1200 = 4200

Net P/L = 4200

After profit, your trading capital = initial capital + profit

Trading capital = 1,00,000 + 4200 = 1,04,200

Account increased in % = 4.2%

What happened, if you increase your capital before drawdown phase?

Now, you have decided to increase and doubled your capital = 1,00,000 + 1,00,000 = 2,00,000

And you have doubled your Risk to Reward, So your –

Risk on each trade = 600

Reward on each trade = 1800

But this month your systems drawdown phase starts

Total trades planned for this month = 10

But because of the drawdown

Total profit = 0 x 1800 = 0

Total loss = 10 x 600 = 6000

After two months of trading, your net capital = (2,04,200 – this month’s loss)

Total capital = 2,04,200 – 6000

Total capital = 1,98,200

Total loss = 2,00,000 – 1,98,200 = 1,800

Total loss = 1,800

Now you can clearly understand what if you increased your capital before the drawdown phase.

Conclusion

The only way to increase your trading capital is after ‘Drawdown’ and when you are 100% confident in your trading strategy and most important when you believe in yourself and your system.

How to manage Risk on our Trading Journal

1. Money Management

On the ‘Money Management’ section, you can manage your trading cash account. You must enter the initial capital you wish to deposit into your trading account. You may also add additional funds or withdraw from your trading account.

Additionally, you may view your overall trading profit and loss as well as the total sum.

Also, you can know the total trade cost (brokerage charges) and the trading capital after trade cost.

And you can also know the total fund added and the total fund withdrawn from the trading account.

Finally, you can know the Available capital to trade. The available capital to trade is calculated by {Initial capital (+/-) Trade Profit/loss (-) Total trade cost (+) Total fund added (-) Total Fund withdrawn} is the formula used to determine the amount of capital that is available for trading.

By clicking the “CASH A/C STATEMENT” button, you can view the statements for trading cash account.

1. Money Management

On the ‘Money Management’ section, you can manage your trading cash account. You must enter the initial capital you wish to deposit into your trading account. You may also add additional funds or withdraw from your trading account.

Additionally, you may view your overall trading profit and loss as well as the total sum.

Also, you can know the total trade cost (brokerage charges) and the trading capital after trade cost.

And you can also know the total fund added and the total fund withdrawn from the trading account.

Finally, you can know the Available capital to trade. The available capital to trade is calculated by {Initial capital (+/-) Trade Profit/loss (-) Total trade cost (+) Total fund added (-) Total Fund withdrawn} is the formula used to determine the amount of capital that is available for trading.

By clicking the “CASH A/C STATEMENT” button, you can view the statements for trading cash account.

2. Goal Achiever

In the ‘Goal Achiever’ section, you can set your yearly and monthly financial objectives. Here you have to decide how many trades you will be taking in a month and also allocate funds to each stock so that you can know how much total capital you need to trade.

And also you have to fix your monthly risk (Amount/%).

To achieve your trading goal you have to analyze the market phase and you need to decide which system to follow in order to achieve your Risk to Reward ratio.

2. Goal Achiever

In the ‘Goal Achiever’ section, you can set your yearly and monthly financial objectives. Here you have to decide how many trades you will be taking in a month and also allocate funds to each stock so that you can know how much total capital you need to trade.

And also you have to fix your monthly risk (Amount/%).

To achieve your trading goal you have to analyze the market phase and you need to decide which system to follow in order to achieve your Risk to Reward ratio.

3. Risk Management & Trade Entry

A very important aspect of trading is “Risk Management/Position Sizing.” Trading is impossible without defined risk. So how can you define your risk?

Exactly sizing positions is the solution. To calculate your position size, you must first decide how much risk you are willing to accept and how much capital you have available to trade with. You must also know your entry and stop loss prices in order to determine the quantity to buy.

You may determine your precise position size, maximum loss, individual stock loss, expected profit, risk to reward, and position value in this risk management section.

Watch this risk management video to learn more.

3. Risk Management & Trade Entry

A very important aspect of trading is “Risk Management/Position Sizing.” Trading is impossible without defined risk. So how can you define your risk?

Exactly sizing positions is the solution. To calculate your position size, you must first decide how much risk you are willing to accept and how much capital you have available to trade with. You must also know your entry and stop loss prices in order to determine the quantity to buy.

You may determine your precise position size, maximum loss, individual stock loss, expected profit, risk to reward, and position value in this risk management section.

Watch this risk management video to learn more.