Equity Swing Trading Journal

Select your section tab to know about how to use this section

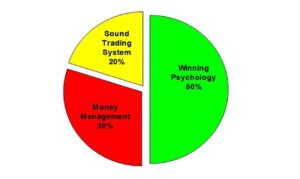

The Ingredients of Successful Trading

In order to achieve consistent success in trading, traders must develop their skills in three major areas

(i) Winning Psychology

(ii) Money Management

(iii) Sound Trading System

And learn from mistakes to maximize winning streaks .